Each one of us does not have the expertise or the time to build and manage an investment portfolio. There is an excellent alternative available – mutual funds.

A mutual fund is an investment intermediary by which people can pool their money and invest it according to a predetermined objective.

Each investor of the mutual fund gets a share of the pool proportionate to the initial investment that he makes. The capital of the mutual fund is divided into shares or units and investors get a number of units proportionate to their investment.

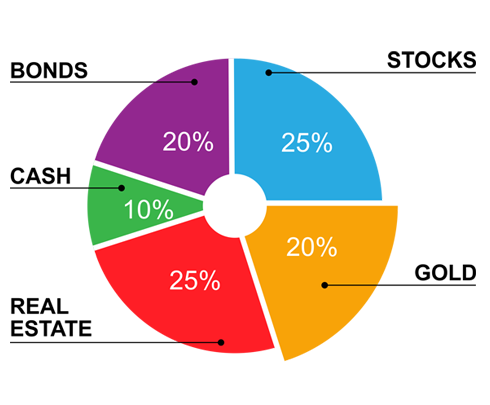

The investment objective of the mutual fund is always decided beforehand. Mutual funds invest in bonds, stocks, money-market instruments, real estate, commodities or other investments or many times a combination of any of these.

The details regarding the funds’ policies, objectives, charges, services etc are all available in the fund’s prospectus and every investor should go through the prospectus before investing in a mutual fund.

The investment decisions for the pool capital are made by a fund manager (or managers). The fund manager decides what securities are to be bought and in what quantity.

The value of units changes with change in aggregate value of the investments made by the mutual fund.

The value of each share or unit of the mutual fund is called NAV (Net Asset Value).

Different funds have different risk – reward profile. A mutual fund that invests in stocks is a greater risk investment than a mutual fund that invests in government bonds. The value of stocks can go down resulting in a loss for the investor, but money invested in bonds is safe (unless the Government defaults – which is rare.) At the same time the greater risk in stocks also presents an opportunity for higher returns. Stocks can go up to any limit, but returns from government bonds are limited to the interest rate offered by the government.

History of Mutual Funds:

The first “pooling of money” for investments was done in 1774. After the 1772-1773 financial crisis, a Dutch merchant Adriaan van Ketwich invited investors to come together to form an investment trust. The goal of the trust was to lower risks involved in investing by providing diversification to the small investors. The funds invested in various European countries such as Austria, Denmark and Spain. The investments were mainly in bonds and equity formed a small portion. The trust was names Eendragt Maakt Magt, which meant “Unity Creates Strength”.

The fund had many features that attracted investors:

- It has an embedded lottery.

- There was an assured 4% dividend, which was slightly less than the average rates prevalent at that time. Thus the interest income exceeded the required payouts and the difference was converted to a cash reserve.

- The cash reserve was utilized to retire a few shares annually at 10% premium and hence the remaining shares earned a higher interest. Thus the cash reserve kept increasing over time – further accelerating share redemption.

- The trust was to be dissolved at the end of 25 years and the capital was to be divided among the remaining investors.

However a war with England led to many bonds defaulting. Due to the decrease in investment income, share redemption was suspended in 1782 and later the interest payments were lowered too. The fund was no longer attractive for investors and faded away.

After evolving in Europe for a few years, the idea of mutual funds reached the US at the end if nineteenth century. In the year 1893, the first closed-end fund was formed. It was named the “The Boston Personal Property Trust.”

The Alexander Fund in Philadelphia was the first step towards open-end funds. It was established in 1907 and had new issues every six months. Investors were allowed to make redemptions.

The first true open-end fund was the Massachusetts Investors’ Trust of Boston. Formed in the year 1924, it went public in 1928. 1928 also saw the emergence of first balanced fund – The Wellington Fund that invested in both stocks and bonds.

The concept of Index based funds was given by William Fouse and John McQuown of the Wells Fargo Bank in 1971. Based on their concept, John Bogle launched the first retail Index Fund in 1976. It was called the First Index Investment Trust. It is now known as the Vanguard 500 Index Fund. It crossed 100 billion dollars in assets in November 2000 and became the World’s largest fund.

Today mutual funds have come a long way. Nearly one in two households in the US invests in mutual funds. The popularity of mutual funds is also soaring in developing economies like India. They have become the preferred investment route for many investors, who value the unique combination of diversification, low costs and simplicity provided by the funds.